Pleads guilty and gets life.

In the end of December 2008 Bernie Madoff called one of his sons into his office and made a startling admission. He was having trouble meeting the $7 billion dollars in withdrawals that his clients were taking. How could this be? Madoff was investment gold and one of the most successful financiers of all time.

It’s true stocks had taken a hit. The subprime mortgage crisis had thrown the markets into chaos. But Madoff’s crisis was not in his brokerage company, it was in his smaller asset management company where high end clients had parked their money to supposedly realize remarkably high and almost guaranteed gains.

As the economy faltered due to the mortgage crisis, Madoff’s clients started to make withdrawals fearing a financial collapse. What his clients didn’t know was that Madoff had been putting their money in a very secure location, A JP Morgan Chase commercial bank account. That was it. There was no investment magic. No all-knowing financial wizardry. He had just been falsifying profits and putting the money in a bank account hoping that his clients would always be investing greater amounts without taking large withdrawals.

Madoff had kept a lid on things by inferring to his clients that he had found a loophole to investing and that they should keep their relationship with him a secret. This way people wouldn’t talk about the fantastic profits he falsified, and he could always get more clients by cherry picking big fish. A classic Ponzi scheme.

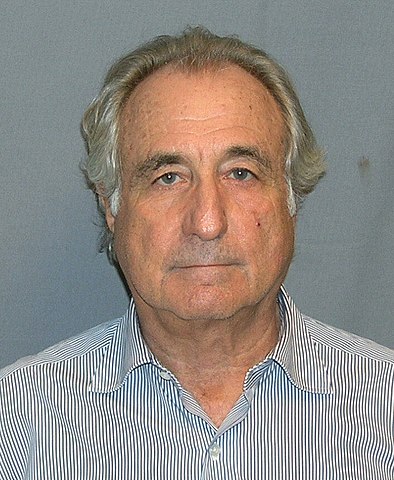

Madoff’s sons went to the authorities after their father’s admission. Within days Madoff was arrested. His collapse came quickly and on March 12, 2009, he pleaded guilty in federal court to eleven felonies and received 150 years in prison.

Madoff admitted to running the scheme since the early 1990’s, but some analysts thought the fraud started as far back 1970’s. Madoff was never legit. People had seen through his con early, but he was never stopped. In 1992 people complained to the SEC about money being raised for Madoff improperly. In 1999 analyst Harry Markopolos had informed the SEC that he had mathematically proven that Madoff’s profit claims were a fraud. In 2004 an SEC lawyer reported to her supervisor that there were serious inconsistencies with Madoff’s practices. In 2001 Erin Arvedlund had written an article that claimed Madoff was a potential fraudster. The article made good points, but the SEC ignored it. Madoff was politically connected (a quarter million in campaign donations will do that) and a chairman on the board of NASDAQ. The SEC and federal government did nothing until Madoff’s son reported him (probably in an attempt to clear their own names).

Madoff died in prison in 2021. His clients lost an estimated 18 billion dollars.

Christopher Flanagan